Exchange of information among team members may or may not be possible, depending on economic and physical constraints. An example of the latter arises in high-frequency trading (1), where messaging across widely dispersed members of a team would be too slow to be useful. The research of Pierfrancesco La Mura (HHL Leipzig Graduate School of Management) and Adam Brandenburger (NYU Ster n School of Business) studies scenarios where direct communication is indeed unavailable, but team members can use their shared global environment to achieve highly effective coordination.

Exchange of information among team members may or may not be possible, depending on economic and physical constraints. An example of the latter arises in high-frequency trading (1), where messaging across widely dispersed members of a team would be too slow to be useful. The research of Pierfrancesco La Mura (HHL Leipzig Graduate School of Management) and Adam Brandenburger (NYU Ster n School of Business) studies scenarios where direct communication is indeed unavailable, but team members can use their shared global environment to achieve highly effective coordination.Trading at the Speed of Light, and Beyond

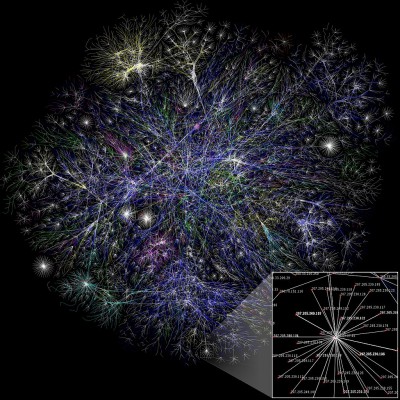

High-frequency traders rely on fast computers, algorithms, and live feeds of financial data from various exchanges in order to decide what and when to buy or sell. Within this environment every millisecond is important, and quicker data links between exchanges minimize the time it takes to obtain new information or to make a trade. As a consequence, companies invest ever increasing amounts of resources in order to access high-speed communication networks, or to host their trading servers as close as possible to the pipeline of important information.

A recent article from Nature (2) explains that, on financial markets, the physical limits of communication have been already reached. While the NASDAQ server processes a new tra de every 0.5 milliseconds, the time needed for communication from, say, New York to Shanghai, even at the speed of light, exceeds 40 milliseconds. Given that such physical limits cannot be overcome, Prof. La Mura and his co-author investigated what other opportunities are available to high-frequency traders and other distributed teams in order to improve cooperation even when communication is not possible.

Quantum-Assisted Trading

One guiding question was: Could it be that in the area of team decision-making, as in cryptography and computing, the availability of quantum resources may lead to improved performance over what is possible in a classical environment? The authors found that access to a quantum network, on which traders active at widely separated locations can make certain measurements on quantum bits generated and transmitted to them from a common source, can enable them to improve their joint performance. The key quantum feature behind the performanc e improvement is the somewhat "telepathic ability of quantum particles to show coordinated behavior even when they are widely separated in space and time. The process is based on a well-studied quantum set-up going back to Bell (3), and discussed as a team decision problem in La Mura (4).

Prof. La Mura says: "Our solution was to show how cooperation can be improved even when communication is too slow to be useful. This is not obtained by trying to out-speed other traders; rather, successful cooperation can arise from balancing market activity at separate locations.

For instance, two high-frequency traders at separate locations who both wish to buy or sell a certain asset would do better operating on different markets, so that they do not need to compete against each other. But if one wishes to sell and the other buy the same asset, then they would do better operating on the same market. Access to a quantum network would allow the traders to avoid each other whe n of the same type, while increasing the probability that they'll share the same market when they are of opposite types.

The research led to a publication in the prestigious Philosophical Transactions of The Royal Society A (5). Prof. La Mura explains that this line of research also led to a new patent application together with NYU, and to an ongoing business project involving partners from the US financial intermediation sector.

Adam Brandenburger is J.P. Valles Professor at the New York University, Leonard N. Stern School of Business.

Pierfrancesco La Mura holds the Chair of Economics and Information Systems at HHL Leipzig Graduate School of Management.

References

(1) Pagnotta E, Philippon T. Competing on speed' NBER Working Paper 17652 (2011); available at https://archive.nyu.edu/bitstream/2451/31369/2/CompetingOnSpeed.pdf

(2) Buchanan M. Physics in finance: Trading at the speed of light' Nature (11 February 2015); available a t http://nature.com/news/physics-in-finance-trading-at-the-speed-of-light-1.16872.

(3) Bell J On the Einstein-Podolsky-Rosen paradox' Physics 1, 195-200 (1964).

(4) La Mura P. Correlated equilibria of classical strategic games with quantum signals' Int. J. Quantum Inf. 3, 183-188 (2005).

(5) Brandenburger A., La Mura P. Team decision problems with classical and quantum signals'. Philosophical Transactions of the Royal Society A (30 November 2015); available at http://rsta.royalsocietypublishing.org/content/374/2058/20150096

HHL gGmbH

Volker Stößel

Jahnallee 59

04109 Leipzig

Deutschland

E-Mail: volker.stoessel@hhl.de

Homepage: http://www.hhl.de

Telefon: 0341-9851-614

Pressekontakt

HHL gGmbH

Volker Stößel

Jahnallee 59

04109 Leipzig

Deutschland

E-Mail: volker.stoessel@hhl.de

Homepage: http://www.hhl.de

Telefon: 0341-9851-614

Keine Kommentare:

Kommentar veröffentlichen

Hinweis: Nur ein Mitglied dieses Blogs kann Kommentare posten.